PFIC Tax Reporting for U.S. Expats | Canada-US Tax Experts

Specialized Form 8621, QEF, and MTM elections with accurate, compliant filings.

U.S. expats living in Canada often discover PFIC rules the hard way. Canadian mutual funds, ETFs, and certain pooled investments can trigger complex U.S. tax reporting, punitive tax calculations, and years of retroactive exposure if handled incorrectly.

Cathy Lalonde Tax specializes in PFIC tax reporting for U.S. individuals, with particular expertise in Canadian mutual funds, Form 8621 filings, and PFIC elections. Our approach is accurate, compliant, and tailored to your specific investment history.

Many clients don’t know they own PFICs until penalties appear.

We review your Canadian and non-U.S. investments to determine which holdings qualify as PFICs under U.S. tax law. This includes Canadian mutual funds, ETFs, income trusts, and certain managed portfolios.

You’ll receive:

Clear identification of PFIC vs non-PFIC assets

Explanation of why each investment qualifies

Guidance on next steps before filing begins

This step prevents unnecessary filings and ensures nothing is missed.

PFIC Identification & Investment Review

Form 8621 is the backbone of PFIC compliance and one of the most misunderstood U.S. tax forms.

We prepare and file Form 8621 for each PFIC, ensuring:

Correct classification of distributions and dispositions

Proper year-by-year income allocations

Accurate reporting aligned with IRS requirements

Whether you hold one PFIC or many, filings are completed carefully and consistently to avoid red flags and future audits.

Form 8621 Preparation & Filing

Choosing the wrong PFIC election can permanently increase your tax burden.

We analyze whether a Qualified Electing Fund (QEF) or Mark-to-Market (MTM) election is appropriate based on:

Investment type and availability of AIS statements

Holding period and prior PFIC history

Long-term tax impact

We explain the pros and cons in plain language and implement elections correctly, including late or retroactive elections where permitted.

PFIC Election Analysis

(QEF vs Mark-to-Market)

When no election is in place, PFICs fall under the default excess distribution regime, often resulting in higher taxes and interest charges.

We handle:

Complex excess distribution calculations

Allocation of income across prior tax years

Interest charge computations required by the IRS

These calculations are technical, time-intensive, and error-prone without specialization. This is where experience matters most.

Excess Distribution & Default PFIC Calculations

Discovered PFICs years later? You’re not alone.

We assist clients who:

Were unaware their Canadian investments were PFICs

Filed U.S. returns without required Forms 8621

Need to correct or amend prior filings

Our focus is on bringing you back into compliance while minimizing penalties and unnecessary exposure.

Late PFIC Filings & Compliance Catch-Up

PFICs held through foreign trusts, corporations, or managed accounts require additional layers of analysis.

We coordinate PFIC reporting with:

Foreign trust filings

Complex ownership structures

Cross-border investment arrangements

This ensures consistent reporting across all required U.S. forms.

PFICs Within Trusts & Complex Structures

This service is ideal for:

U.S. citizens living in Canada

Dual citizens with Canadian investments

Americans holding Canadian mutual funds or ETFs

Clients with prior PFIC filing errors

Individuals with trusts or complex portfolios

If your investments feel “too complicated” for general tax software, you’re in the right place.

Who This Service Is For

PFIC rules are complex, but understanding them helps you make better investment and tax decisions. Below are in-depth resources written specifically for U.S. expats in Canada.

PFIC Resources for U.S. Expats

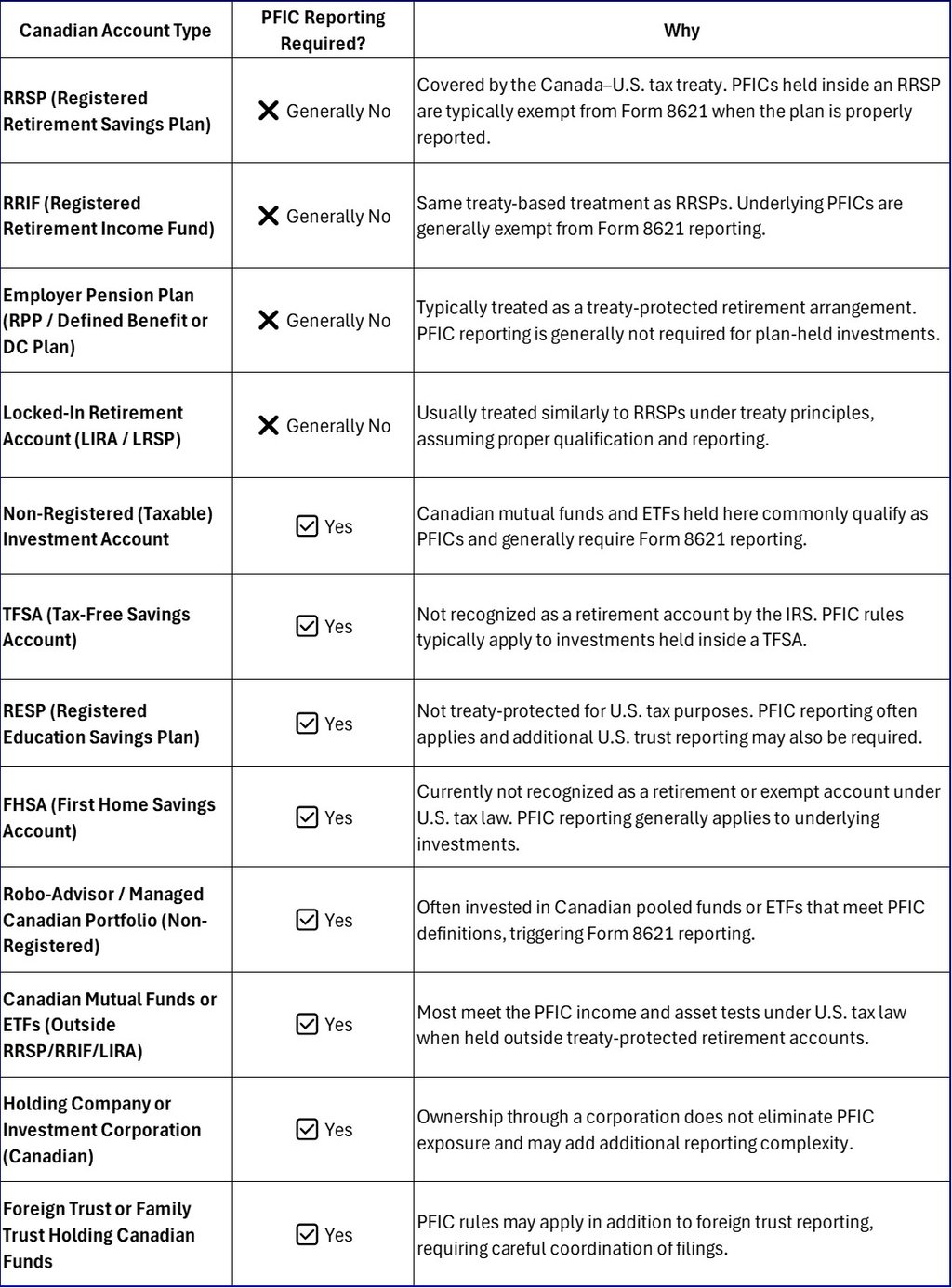

Canadian Accounts:

PFIC Exempt vs Non-Exempt

PFIC treatment depends on both the type of investment and the type of account. While certain Canadian retirement accounts are generally exempt due to treaty protections, most savings and non-registered accounts do not receive the same treatment under U.S. tax law.

In addition, exemptions rely on proper account qualification and reporting. Assumptions without professional review can lead to missed filings and long-term exposure.

PFIC reporting is not a DIY exercise.

Errors compound quickly and fixing them later is far more costly than getting it right the first time.

If you hold Canadian investments and file U.S. taxes, professional PFIC guidance matters.

Contact Cathy Lalonde Tax to discuss your situation and ensure your PFIC reporting is handled accurately and compliantly.

Contact

Get in touch for tax assistance.

Follow

Connect

cathy@cathylalondetax.ca

519-233-3588

© 2025. All rights reserved.